How the Right Platform Tech Can Help Close the Financial Advice Gap

There’s been a growing conversation around how digital tools can help bridge the advice gap in financial services. And while technology certainly holds promise, not all of it is helpful. In fact, some platforms may be making things more complicated.

A recent Money Marketing article made a crucial point: in the rush to digitise, providers risk adding layers of complexity that hinder, rather than help, advisers. If new tools lead to more admin, a clunky experience, or a steep learning curve, they may widen the very gap they aim to close.

The Issue Isn’t a Lack of Tech, It’s the Wrong Kind

At Digital Wealth Solutions, we work closely with financial advisers and hear a recurring frustration: most platforms aren’t designed with their needs in mind. Instead, they’re built for providers , often packed with features advisers don’t need, wrapped in interfaces that slow them down.

Our view? Technology should simplify advice, not complicate it.

That’s why we’ve developed a platform that puts advisers and their clients first. Here’s how Digital Wealth Solutions helps close the advice gap by making advice delivery easier, not harder:

1. Integrated Digital Fact Finds

Our streamlined, client-focused fact finds reduce form-filling time and increase data accuracy. This means advisers can move quickly from information gathering to personalised advice conversations.

2. Built-In Recommendation Packs

Create tailored recommendation packs in just a few clicks - complete with audit trails to document what was shared, when, and with whom.

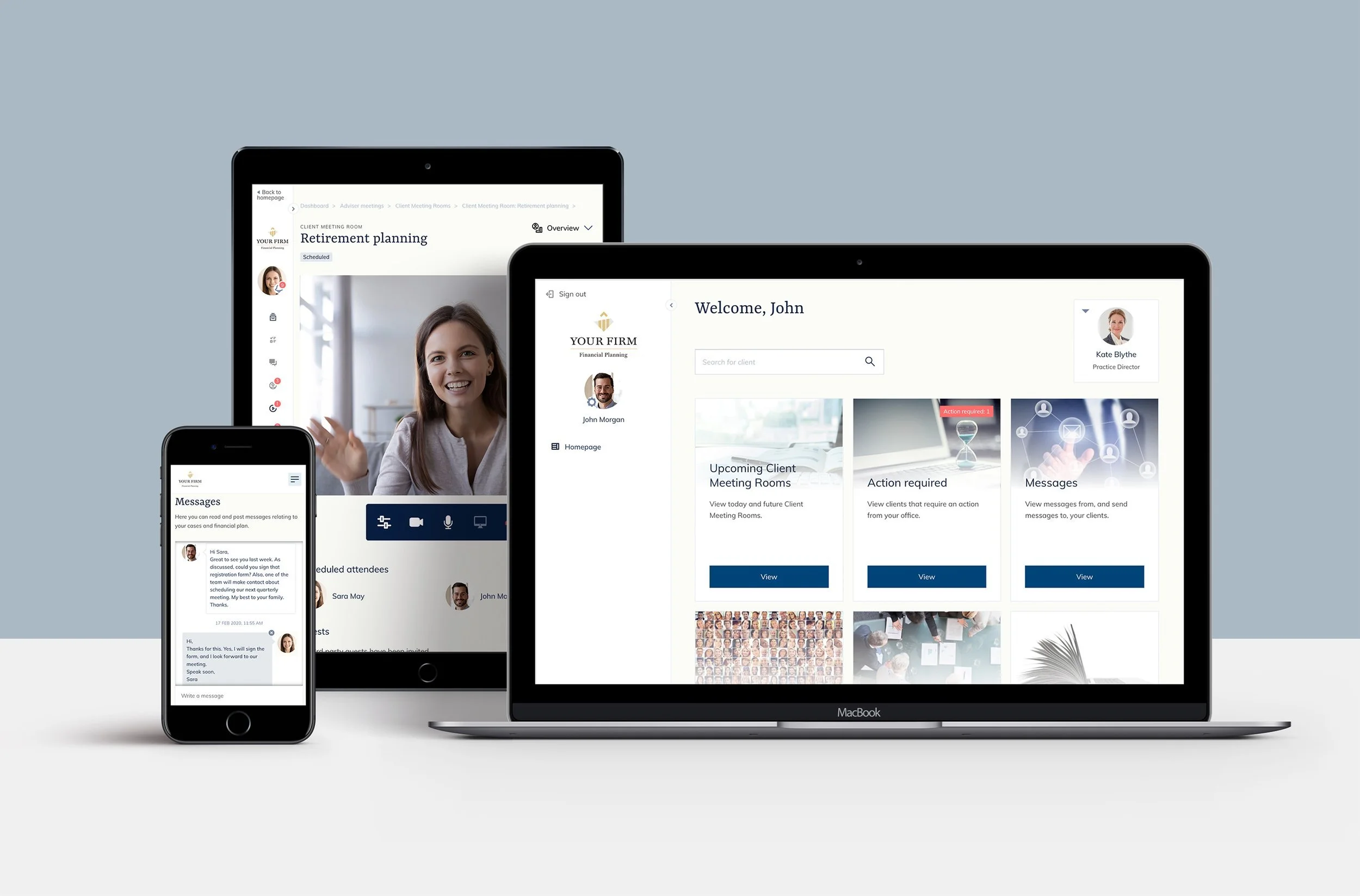

3. Seamless Client Communication

From secure messaging to shared actions and reminders, our tools reduce the need for follow-up calls and lengthy email threads. Everything stays in one place, clearly tracked.

Plus, our dedicated iOS client app gives clients easy access to key documents, messages, and next steps - making the entire advice journey more transparent and engaging.

4. Virtual Meetings and Flexible Advice Models

Our platform supports hybrid advice, so you can meet clients in person or online without compromising service quality, all through one centralised portal.

5. Built for Real Advisers, Not Robo-Solutions

We’re here to enhance human advice, not replace it. Our platform makes it easier for advisers to serve more clients with care and confidence, including those who might otherwise miss out.

Tech That Supports, Not Distracts - From Great Advice

Advisers don’t need bells and whistles - they need dependable tools that work. That’s the gap we’re helping to close. By reducing admin, improving communication, and making hybrid advice delivery seamless, Digital Wealth Solutions enables advisers to focus on what really matters: helping people.

Let’s make advice more accessible, one tool at a time.

If you’d like to see our platform in action, please book a demo below, all going well, you could start onboarding clients with a free 2 month trial and no setup fee.