How Can Financial Advisers in the UK Strengthen Client Relationships in 2025?

Advisers hear it often, building client relationships is at the heart of success. But recent data shows this isn’t just a soft priority - it’s becoming business-critical.

According to research by Unbiased reported in Professional Paraplanner, 34% of advisers say client acquisition is their top priority over the next 12 months, and 23% place client retention first. That’s more than technology adoption (14%) or compliance (8%) when it comes to priorities. (Source)

It tells you where the market is headed, firms that build trust and deepen relationships will stay ahead.

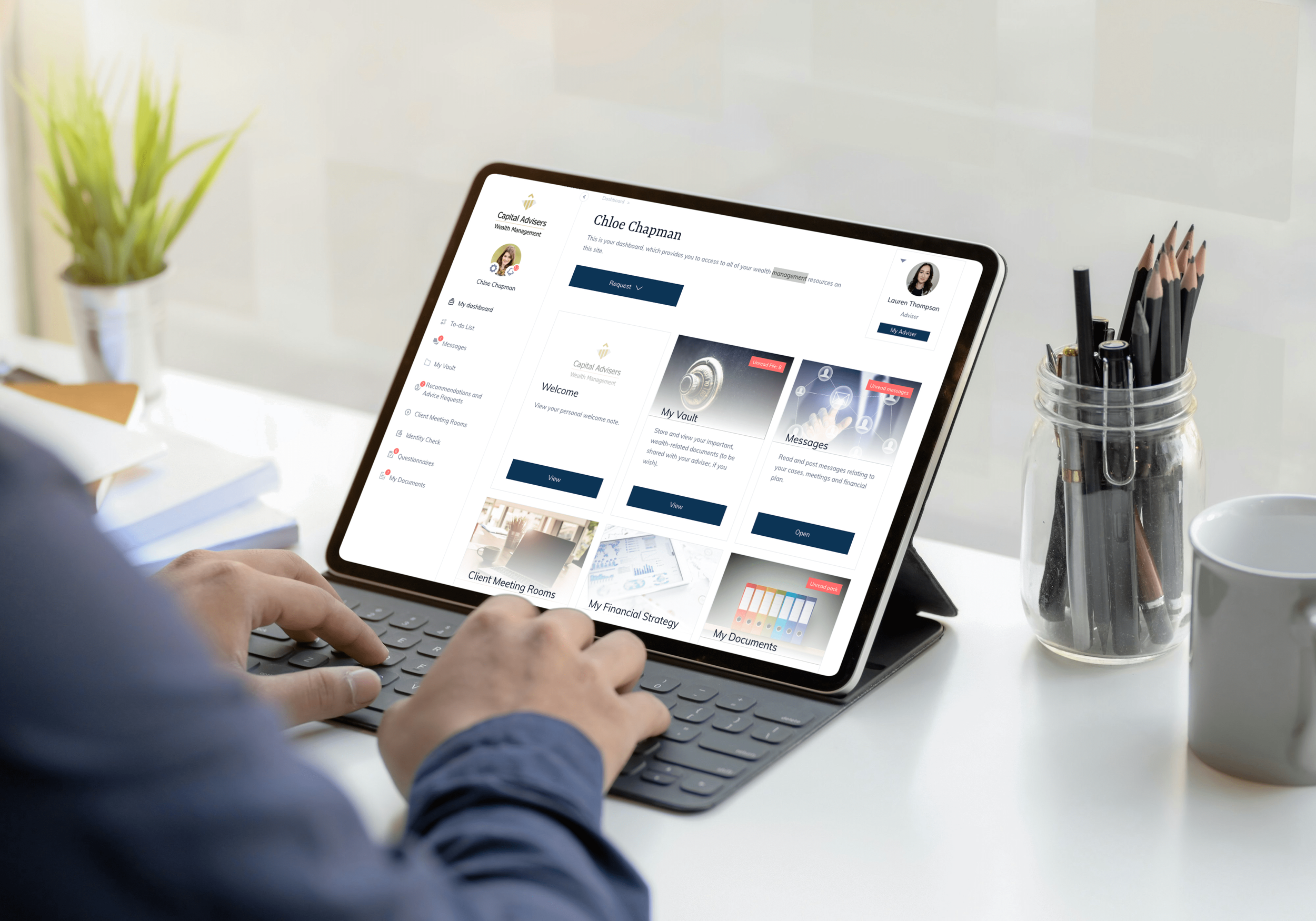

If you want to deliver outstanding client outcomes, deepen loyalty, and manage wealth better, you’ll probably need to do more than the traditional methods. Here’s how adviser tech, especially a strong client portal, can help - and what to do first.

What Do Advisers Say About Using Client Portals?

“Workflows feel smoother. Audit trails give both us and clients full visibility. It’s efficient for us and intuitive for clients.”

- Adviser using Digital Wealth Solutions

This testimonial captures exactly what clients are looking for - ease, clarity, and efficiency. It also shows what advisers can deliver when they use modern technology effectively.

How Can Technology Improve Client Relationships? 7 Ways to Turn These Priorities into Action

Here are seven practical ways advisers can use tech tools and client portals to make relationships a competitive edge:

What is the benefit of a secure client portal?

It centralises messaging, document sharing, signatures and records, reducing friction. Clients know where to go. Advisers save time.How does client segmentation help financial advisers?

Financial advisor client segmentation allows you to tailor messages to specific groups - young professionals, retirees, or high-net-worth individuals - so communication feels personal and relevant.Why digitise onboarding and annual reviews?

Digital fact finds, recommendation packs, and pre-meeting questionnaires mean client time is focused on advice, not admin.How do virtual meetings add value?

With secure video, messaging, and shared documents inside one client portal, the meeting experience feels seamless and professional.Why do audit trails matter in financial advice?

They provide compliance protection while giving clients transparency, which builds trust.How does digital document management save time?

Signatures, document packs and storage in one place cut out printing, postage, and chasing lost paperwork.What role does consistent communication play in retention?

Regular updates, reviews, and goal tracking help clients feel valued and reduce attrition.

Why Are Client Relationships More Important Than Ever?

The statistics show advisers in the UK are putting client acquisition and retention ahead of technology adoption and compliance. This shift highlights the reality: technology is not the end goal - it is the tool that enables advisers to strengthen the human side of financial planning.

Firms that embed advanced tech and client portals into their processes can:

Save hours of admin each week

Reduce mistakes and missed opportunities

Improve both client acquisition and retention

Deliver compliant, personal service at scale

How Should Advisers Prepare for 2025 and beyond?

Client relationships are no longer a “soft skill” - they are a growth strategy. Advisers who use digital wealth tools and client portals for financial planning will be positioned to scale, deliver more value, and meet the expectations of younger, tech-savvy clients as well as established investors.

Want to see what this looks like in practice? We’d be happy to share how advisers who use Digital Wealth Solutions are already transforming their client relationships. We’re currently offering a free trial for 2 months, which gives you ample time to see how Digital Wealth Solutions can fit into your business.

Frequently Asked Questions

What is the best client portal for financial advisers in the UK?

The best client portal is one that combines secure messaging, document sharing, digital signatures, and audit trails in one place. Solutions like Digital Wealth Solutions are designed specifically for advisers and their clients.

Why should advisers use client segmentation?

Client segmentation helps advisers provide tailored communication and financial planning services, improving engagement and retention. It ensures younger clients, retirees, and high-net-worth individuals all feel valued.

How does a client portal improve compliance?

Portals create clear audit trails and centralised records, which protect advisers while providing transparency for clients. This reduces risk and saves time on reporting.

Do younger clients expect digital wealth tools?

Yes. Research shows tech-savvy clients prefer advisers who offer digital communication, portals, and real-time access. Firms that adapt early are better positioned to attract and retain younger generations.

Is technology replacing the adviser?

No. Technology supports advisers by removing admin and improving efficiency. The human relationship remains at the core of advice - tech just makes it easier to deliver consistently.